The Real Impact of Debt Consolidation on Your Credit Score

If you have multiple debts you want to repay, debt consolidation is one solution you could consider. Before consolidating your debts, it's important to understand how this works and how it can help or hurt your credit score. This guide will explain your options and help you decide whether debt consolidation is a smart step on your road to financial peace of mind.

What Is Debt Consolidation?

Debt consolidation means combining several debts into one loan or payment. The aim is to help you manage your debt by giving you just one monthly payment to track and potentially giving you a more favorable interest rate, reducing the total amount you pay in interest and saving you money. Debt consolidation also simplifies your repayment timeline, making it easier to project when you'll be debt-free. If you manage your payments well after consolidation, it can even lead to long-term credit score improvements.

4 Debt Consolidation Options

The results you can achieve through debt consolidation depend on your debts and the type of loan or credit account you use to consolidate them. There are four main ways to consolidate debt, each with different pros and cons.

1. Personal Loans

A personal loan is a straightforward, lower-risk debt consolidation solution. Personal loans are also known as debt consolidation loans when used for this purpose.

To use a personal loan for consolidating debt, you take out a lump sum loan and use it to repay all your existing debts. You then make fixed monthly payments on the personal loan until it's paid off. This is especially helpful for consolidating credit card debts, because you get a structured repayment plan, and personal loans tend to have lower interest rates and better terms than most credit cards. The advantages of personal loans for debt consolidation include:

- Predictable payments: Reputable lenders offer fixed interest rates on personal loans, resulting in a predictable monthly payment for easier budgeting.

- Collateral-free lending: While some personal loans are secured, most are unsecured, so your assets are safe. Secured loans require an asset for collateral, such as your vehicle. Unsecured loans do not require collateral.

- Versatility: You can use a personal loan to repay any type of debt, including credit cards, car loans, student loans, and medical bills.

- Credit-building potential: A debt consolidation loan's impact on your credit score could be a net positive if you keep up with payments.

It's important to recognize that every solution, including a personal loan, has its limitations. While you can find affordable personal loans online, some debt consolidation lenders charge high interest rates or deny loans to people based only on a poor credit score. As with all debt consolidation methods, using a personal loan to close older credit accounts and loans will cause a temporary hit to your credit score by reducing the average age of your credit accounts. Your credit score may also be reduced due to the hard inquiry — when a lender checks your credit report — required when you open a new account.

2. Balance Transfer Credit Cards

Balance transfer cards are credit cards that offer introductory periods of a year or more with low or no interest charges on balances you transfer to the card. Transferring your debts to a balance transfer card allows you to make progress toward repaying your consolidated debt with substantial savings on interest. This is the main advantage of a balance transfer card, but some cards have added perks like rewards programs.

While they can be very helpful if you have a realistic plan to pay off your full balance during the introductory period, balance transfer cards have significant limitations as a debt consolidation tool:

- Most issuers require you to have a good credit score before approving you for a balance transfer card.

- Most issuers charge a balance transfer fee of up to 5% of your transferred amount. Balance transfer cards may also have additional fees, such as annual or cash advance fees, so be sure you understand the fee structure.

- Interest rates on an outstanding balance after the introductory period may be very high. Ensure you understand how long the introductory period is. It's a good idea to add reminders to your calendar so you can make ample progress toward paying down your debt.

- Using your card for purchases brings a risk of accumulating more high-interest debt.

- Opening a new card could briefly lower your credit score since it requires a hard inquiry.

If you're considering debt consolidation with a balance transfer card, check that the card's credit limit is high enough to cover the debt you intend to transfer.

3. Home Equity Loans and HELOCs

Home equity loans and home equity lines of credit (HELOCs) are two ways to borrow money for debt consolidation against equity you've built up in a home. A home equity loan is a lump sum with a fixed repayment plan, while a HELOC works more like a credit card, but both involve borrowing with your home equity as collateral.

The advantage of using a HELOC or home equity loan for debt consolidation is that the interest rate may be lower than you'd get from an unsecured loan. Plus, provided you have the home equity, you can likely qualify for a HELOC or home equity loan even if your credit score is less than stellar.

The reason lenders are willing to offer such favorable terms is that you take on more risk than they do by putting up your home as collateral. This situation means you could lose your home to the lender if you fail to settle your balance. If you opt for a HELOC, you may also have a variable interest rate, making your payments unpredictable.

4. Debt Management Plans

Debt Management Plans (DMPs) involve working with a credit counseling agency to create a structured repayment plan for your debts. The agency may negotiate lower interest rates with your creditors, saving you money. A DMP can function as a form of debt consolidation because you make one monthly payment to the agency, and they pay your creditors on your behalf.

A good DMP from a reputable agency can save you money and simplify your debt repayment experience. Note that the agency will likely charge a fee and may require you to close credit accounts and prevent you from opening new accounts while the DMP is in place. This can hurt your credit score in the short term and restrict your options, though it may help you stay committed to getting out of debt.

How Does Debt Consolidation Affect Your Credit?

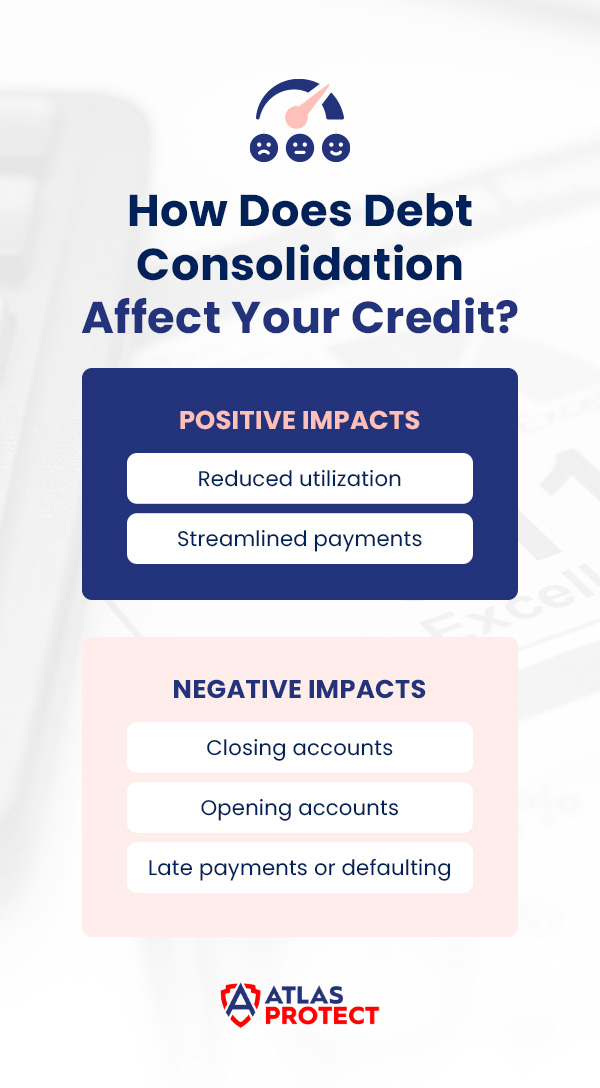

Debt consolidation can have positive and negative impacts on your credit score, depending on your debts, the time frame you're considering, your approach to consolidation, and how you handle payments after consolidation.

Positive Impacts of Debt Consolidation on Your Credit Score

A smart approach to debt consolidation could improve your credit score, especially in the long term. Here's how:

- Reduced utilization: Your credit utilization ratio is the percentage of your available credit you're using. The lower the ratio, the better for your credit score. If you keep your older credit accounts open but avoid using them after consolidation into a new account, your overall credit utilization ratio will be lower, since you'll have access to more credit than you're using.

- Streamlined payments: Having multiple debts with different due dates and interest rates can be difficult to manage, increasing the risk of missed payments. Debt consolidation combines all your debts into one monthly payment, making it easier to stay organized and make timely payments. This improves your credit score over time and shows any future lenders that you're a responsible borrower.

Negative Impacts of Debt Consolidation on Your Credit Score

Debt consolidation can be bad for your credit score in the short term, and potentially in the long term as well, because of factors like:

- Closing accounts: Closing old credit accounts can hurt your credit score by reducing your average credit account age and shrinking your available credit, which increases your utilization ratio.

- Opening accounts: Opening a new credit card or loan account can temporarily lower your credit score. It usually involves a hard inquiry, which lowers your score slightly each time. Lenders also see new lines of credit as riskier.

- Late payments or defaulting: If you miss payments or default on a new consolidated loan, the impact on your credit score can be severe and long-lasting.

How to Consolidate Debt and Protect Your Credit Score

If you decide to consolidate your debts, understanding the potential cons can help you mitigate them and protect your credit score. For example, maintain your old accounts but avoid using them to keep your credit utilization ratio low. Shop around for the best interest rates and terms before applying for a new loan or credit card to minimize hard inquiries.

Most importantly, once you've consolidated your debts into a new loan, make your payments on time, every time. Debt consolidation will not affect your credit negatively for long if you keep up with payments afterward, as timely payments can offset the temporary knock from hard inquiries.

You should also check your credit report regularly to track your progress, identify any errors, and correct them.

Is Debt Consolidation Right for You?

Before deciding whether debt consolidation is right for you, ask yourself these six questions:

- How much debt and what kind do you have?

- What are your interest rates on each debt?

- What is your credit score?

- Can you afford the monthly payments on a consolidated loan and avoid accumulating new debt?

- Are you committed to changing your spending habits and addressing the root causes of your debt?

- Have you compared the total cost of debt consolidation, including fees and interest, to the cost of your current debt repayment plan?

Considering your answers to these questions, debt consolidation does work well if you:

- Want a simple way to manage your payments and save money on interest.

- Have high-interest debt and can qualify for a loan with a lower interest rate to cover it.

- Are disciplined and committed enough to make timely payments and avoid new debt.

However, avoid debt consolidation if you:

- Only qualify for high-interest consolidation loans and credit cards.

- Struggle with overspending and are likely to accumulate more debt.

- Lack a realistic plan for repayment after consolidation.

Alternatives to Debt Consolidation

If debt consolidation doesn't make sense for you, you still have debt relief options to achieve financial peace. These include:

- The debt avalanche method: Pay off your debts one at a time, starting with the one with the highest interest rate while making minimum payments on the rest, until you repay them all. This method is the most cost-effective approach to repaying debts, but it requires discipline to stick to the plan when your first big win could take months or years.

- The debt snowball method: Pay off your debts one at a time from smallest to largest. You may pay more total interest than with the avalanche method, but the quick wins help with motivation.

- Credit counseling: Nonprofit credit counseling agencies offer budgeting and debt management support, which may include implementing a DMP and negotiating with creditors on your behalf. This option could be a sound choice if you need hands-on financial guidance.

- Debt settlement: If you're experiencing serious financial hardships, you may be able to negotiate with your creditors to settle debts for less than you owe, but the damage to your credit score can be severe.

- Bankruptcy: This is a legal process where a court decides whether you are unable to repay your debts. The court may reorganize your repayment plans or eliminate your debt, but this heavily impacts your credit score for up to 10 years. Bankruptcy is a last resort when you have no other viable options to repay your debts.

Whether you choose debt consolidation or an alternative, it's essential to practice budgeting and financial planning skills to keep future debt in check.

Why Trust Us?

Atlas Credit is the go-to responsible and reputable personal lender with over 50 locations in Texas and Oklahoma and a reliable online lending service. We have decades of experience providing personal loans, including debt consolidation loans, to people with diverse financial circumstances.

Our employees have high levels of expertise in the financial industry and a degree of professionalism that our customers appreciate. We are committed to helping our customers understand their finances before they receive their loan. This part of our service includes income, debt, and expense analysis with budgeting to empower borrowers. Having helped people from every walk of life through this process, we have gained a deep understanding of debt consolidation strategies and their real-life implications.

Experience Financial Relief With Atlas Credit

Managing multiple debts can be stressful, especially if those debts include high-interest credit balances. With a favorable interest rate and a realistic repayment plan, debt consolidation could be a smart solution. However, it's important to understand that the impacts on your credit score can be mixed. If you want a personal loan to consolidate debts, avoid high-interest cards, or build good credit, you can apply online with Atlas Credit.

Atlas Credit has been providing affordable personal loans since 1968, and we look at more than your credit score when considering applications. You can complete our secure online loan application in minutes, sign the documents electronically after a quick verification, and potentially receive your loan funds as early as the next business day. You're also welcome to contact our team for expert guidance about your personal debt consolidation lending and credit-building options.

Apply for your personal loan today to experience the financial relief you deserve.