When you have an emergency expense, choosing the right financing option matters. Many people compare credit cards and personal loans as options for financing. Both can help you manage major expenses, but understanding how they function allows you to choose which option is right for you.

What Are Credit Cards?

Credit cards offer a revolving line of credit, so you can use them as needed, repay what you owe and continue using them again. You have access to funds whenever you use your card. Some credit cards offer cash advances, but these transactions come with high fees and interest.

What Are Personal Loans?

A personal loan gives you a fixed amount of money upfront, making it easier to handle large expenses immediately. You repay the loan through set monthly payments over a defined schedule, giving you predictability and control.

What Is the Difference Between Credit Cards and Personal Loans?

While both options can help you pay for important expenses, their structure and repayment styles differ.

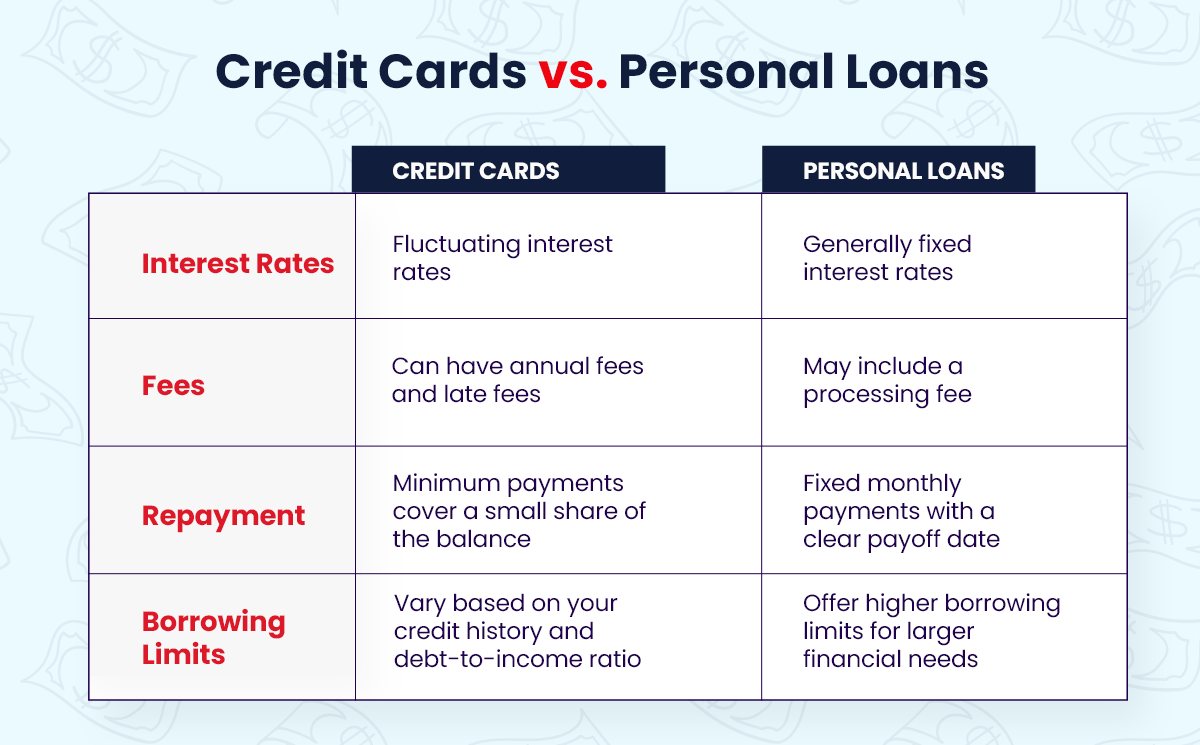

1. Interest Rates and Fees

Credit card interest rates will influence your long-term budget, and they can fluctuate. Credit cards also charge annual fees and late fees. When a balance remains on the card after your payment is due, the total amount you'll end up paying increases, creating challenges in managing large expenses while staying within a reasonable budget.

In contrast, personal loans generally offer a fixed rate. This structure ensures the total interest remains predictable throughout the loan's life. Personal loans may include a processing fee, which the loan representative will explain to you before you sign any documents. It also establishes a clear payoff date — that stability is a key advantage for many people.

2. Repayment Terms

Credit card minimum payments cover a small share of the balance, making them appealing in the short term but costly over time. If you only make minimum payments, credit card debt can remain for years, impacting your financial goals in the future.

Personal loans use fixed payments, meaning your monthly payment stays the same until you've repaid the loan. This consistency supports better budgeting.

3. Borrowing Limits

Credit card limits vary based on your credit history and debt-to-income ratio. They can rise over time, but are often lower than what you may need for large expenses. Personal loans offer higher borrowing limits because they're specifically designed to meet larger financial needs, such as debt consolidation or medical bills.

When to Use a Credit Card vs. a Personal Loan

Choosing the right option starts with clarifying your personal goals, your timeline and your comfort level with repayment. Start by estimating the full cost of the expense and how quickly you want it resolved. Review your existing debts to determine whether it's better to use credit cards or loans for your long-term plans. The right option should reduce financial pressure and help you stay prepared for your next major milestone.

A credit card is helpful in situations where you can prevent the balance from building interest. Clearing the charge quickly gives you convenience when:

- You need a quick solution for a small purchase

- You prefer to earn rewards on everyday spending

- You can pay the balance in full within the next month

- You want a safety net for small, unexpected expenses

A personal loan is best for borrowers who value predictability and those who want to avoid rising interest charges in these situations:

- Covering a large, planned expense

- Managing emergency repairs

- Consolidating high-interest debt

- Setting a defined payoff strategy

- Handling medical or home repair costs

How Each Option Affects Your Credit Score

Your credit score influences your access to financing, the APR rates you're offered and the cost of borrowing over time. Responsible management enhances your financial standing, helping with future lending opportunities. Here's how loans and credit cards affect your credit score:

Credit Utilization

Credit utilization applies to revolving credit. When you use a credit card, the percentage of available credit you spend affects your score — high utilization signals risk to lenders and can lower your credit score. Keeping balances low shows stability and supports healthier credit over time.

Personal loans don't affect utilization because they're installment accounts. This separation can help you maintain a steady credit score.

Payment History

Consistent, on-time payments show reliability, while late or missed payments harm your record and can remain visible for years. Credit cards and personal loans both report activity to credit bureaus, so making timely payments strengthens your profile, regardless of the account type.

Fixed installment loans make it easier to stay on track. Credit cards need more attention because the minimum amount due shifts with your spending patterns, making discipline essential.

Credit Mix

Consider your credit mix, which reflects the variety of accounts in your profile and lets lenders see that you can manage different types of credit responsibly. Having both a personal loan and a credit card, when used responsibly, can help improve your score by demonstrating a balanced credit experience. The goal isn't to open accounts you don't need, but to maintain healthy habits with the accounts you already have.

Why Trust Us

At Atlas Credit, we use a borrower-first approach grounded in transparency, clear communication and respectful guidance. Our representatives will walk you through every step and ensure you understand the terms of your personal loan before you commit.

When you apply for a personal loan with us, it won't affect your credit score. We conduct a soft inquiry that's purely for reference — this way, you can establish credit without impacting your future ability to secure larger loans.

Our team focuses on practical solutions that help you easily find a loan that aligns with your budget and timeline. We're here to help you move forward with confidence, offering dependable service and straightforward options.

Choose Atlas Credit for Your Personal Loan Needs

By comparing the structure, cost, repayment style and long-term impact on your credit score, you can approach big financial decisions with clarity. Whether you need a personal loan or a credit card, partnering with the right service provider is essential.

At Atlas Credit, we've supported thousands of customers since 1968. We accept a range of credit scores and consider more than your credit history — we know how quickly your situation can change. Visit one of our locations in Texas, Oklahoma or Virginia, or apply for your personal loan online and get your quote in minutes.