Personal loans can be helpful if you're in a bind. Depending on the lender, you can use the cash to pay for home repairs, medical expenses, or to consolidate your existing debts. TransUnion — one of the biggest credit reporting agencies in the U.S. — reports that in the first quarter of 2025, the total balance for personal loans amounted to $253 billion, where 24.6 million consumers had balances. The most common loan purpose is for debt consolidation.

If you're also looking to qualify for a personal loan, make sure you're getting the best terms. Lenders usually have similar requirements, but some are more lenient than others. Preparing for these requirements beforehand can improve your chances of approval. This article breaks down the details.

Unsecured vs. Secured Personal Loans

Before diving into the requirements, identify whether an unsecured or secured personal loan works better for you. A secured personal loan is a type of loan secured with collateral. The lender will repossess the collateral in the case of nonpayment or default. Usually, the type of loan determines the collateral. For instance, if you opt for an auto loan, the car is the collateral, and the lender will take the vehicle if you fail to repay the loan.

For secured loans, your collateral could be your car, house, insurance policy, or the cash available in your savings account. If the collateral's value is more than the remaining debt you owe, you'll receive the difference. Secured personal loans can be easier to apply for since they pose lower risks to lenders, thanks to the collateral. If you don't have any assets that can serve as collateral, you may consider opting for unsecured loans.

Unsecured personal loans can be pricier because of a higher interest rate. Lenders charge more for unsecured loans due to the higher risk involved from not having collateral, although unsecured loans are more common for personal loans. Approval will also likely be based on your income, outstanding debt, and credit score. The upside is that you won't risk losing an asset if you fail to pay back the loan, although your credit will take a hit.

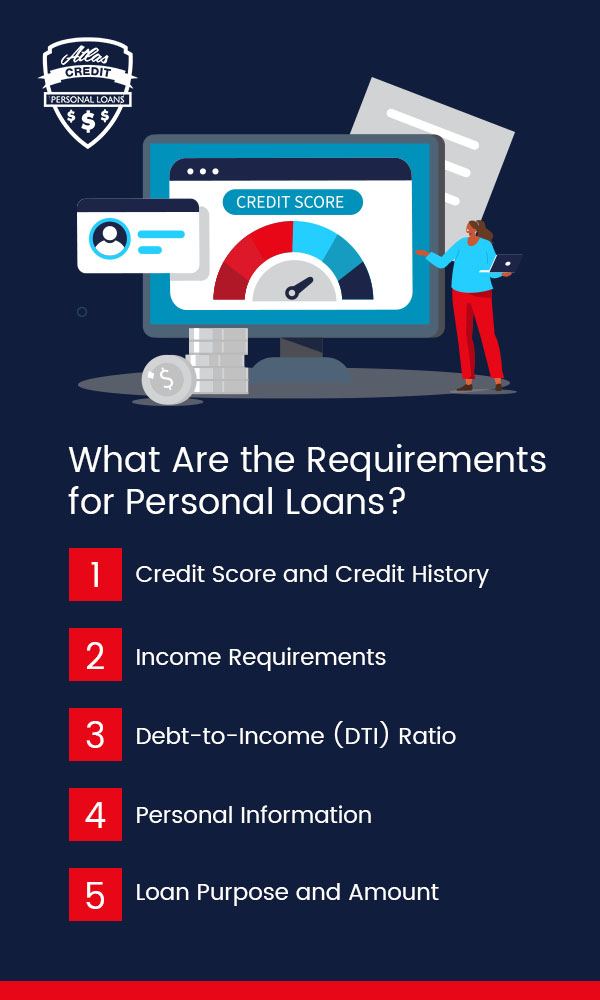

What Are the Requirements for Personal Loans?

Whether you opt for an unsecured or secured personal loan, eligibility requirements typically include:

1. Credit Score and Credit History

Lenders usually consider your credit score when determining your trustworthiness in paying back the loan. They could refer to your FICO credit score or your VantageScore, although FICO scores are more often used. Credit scores range from 300 to 850, where most lenders consider a score of 670 or above good. This score represents your personal credit rating based on your ability to repay debts. Credit bureaus calculate credit scores based on your credit report information. The higher your score, the better the loan terms you can get.

However, some lenders still offer personal loans to those with thin or poor credit — those with scores of 300 to 629. Lenders only need to refer to the other requirements, such as income and stable employment history, instead of your credit score.

You should review your credit history for any inaccuracies, as they can negatively impact your score. You can get a free copy of your credit report from AnnualCreditReport.com. The three main credit bureaus — TransUnion, Equifax, and Experian — may have slight variations in their calculations, but they mainly consider:

- Debts you owe

- Payment history

- How many different types of credit you have

- Length of your credit history

For instance, if you have credit cards or credit lines, your credit utilization ratio impacts your credit score. This ratio shows the amount of credit you've used as a percentage, where a lower ratio is better. According to Experian, people with good credit scores (670-739) have an average credit utilization ratio of 35.2%.

You can aim for a utilization rate lower than this average to increase your chances of loan approval. To calculate your utilization rate, divide your total debt by the total credit limit you have available. You can improve your utilization ratio by reducing your debt per card and not closing any paid-off cards, decreasing your use and increasing your total available credit limit.

2. Income Requirements

Lenders need to know how you can repay them. You need to prove that you have a steady income or cash flow, which can include alimony, Social Security payments, or income from your household members. There's usually a minimum monthly or annual income requirement, and you can show that you meet this requirement through your W-2s, payslips, or other applicable documents.

3. Debt-to-Income (DTI) Ratio

Your debt-to-income ratio shows how much of your monthly income you spend on monthly debt payments. This percentage tells lenders whether you can take on more loans, so a lower DTI is better. To calculate, add all your minimum monthly payments and divide them by your gross monthly income, or income before taxes and deductions. If your monthly debt payments equal $2,000 and your gross monthly income is $5,000, you would have a DTI ratio of 40%.

Lenders may have varying standards, but a DTI ratio of 35% and lower is generally good.

4. Personal Information

Your application will require documents that provide your personal information. For instance, a lender may ask for your proof of identity, which can be your:

- Government-issued ID, such as a driver's license or birth certificate

- Social Security number

- Individual taxpayer identification number

They may also ask for your proof of address, which can be from a mortgage statement or utility bill.

5. Loan Purpose and Amount

Lenders may ask you about the purpose of the loan if they restrict certain use cases. For instance, they may prohibit using the personal loan for:

- Home down payment

- College tuition

- Investments

- Business capital

Your lender can also specify their allowed use case. Commonly accepted purposes include:

- Home improvement expenses: If you need the money for home repairs or want to renovate your home, some lenders allow personal loans for home improvements.

- Travel expenses: Although it's not the best idea to take out a loan for travel expenses, some lenders allow personal loans for this purpose. You may use the funds for transportation, lodging, or other entertainment expenses.

- Medical expenses: You may have surprise health care expenses you didn't budget for. Some lenders may let you use the funds for hospital bills, outpatient treatments, or other procedures.

- Emergency expenses: Maybe your car broke down, or you need a new kitchen appliance. If you don't have an emergency fund, you can opt for personal loans to pay for these sudden expenses.

- Debt consolidation: You might find a loan that can pay for all your individual debts while offering better rates and terms. This makes managing your monthly payments easier, while potentially offering more savings in the long run.

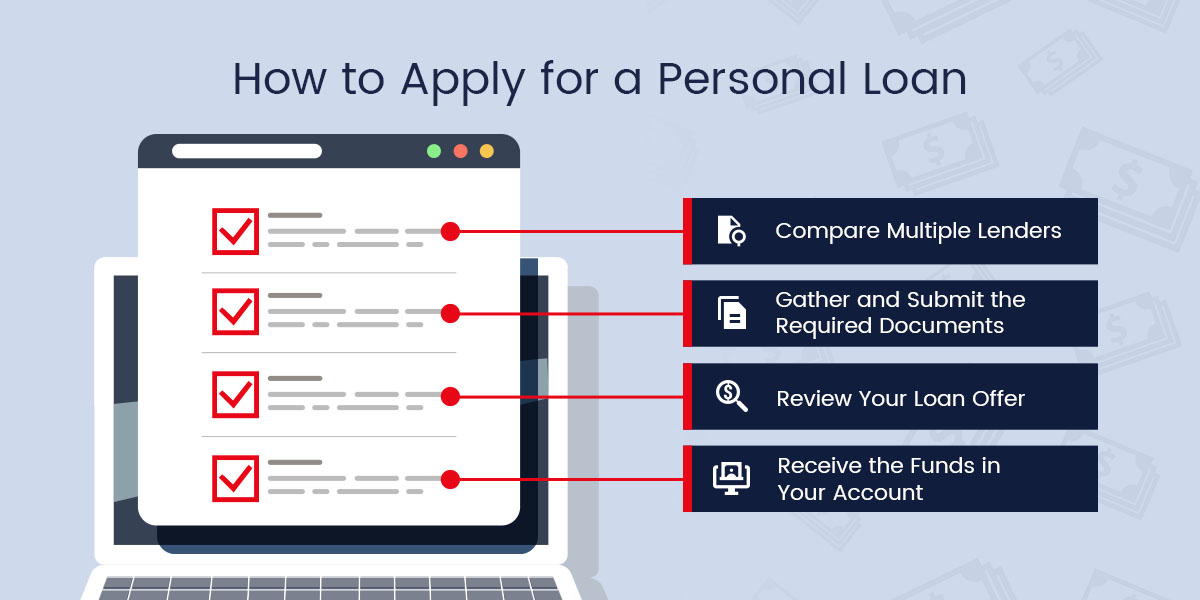

How to Apply for a Personal Loan

Once you've determined your qualifications for a personal loan, you can start looking for the right lender. The application process may slightly differ for each. Here are the steps you can take to apply:

1. Compare Multiple Lenders

You should find a lender with a loan that fits your qualifications. The personal loan's credit requirements may be your primary consideration. If your credit score is on the higher end, then you have more options for a lender. However, lenders like Atlas Credit don't primarily consider credit scores, so you can still qualify for a loan regardless.

When reviewing your options, you should also consider the following:

- Annual percentage rate (APR): The APR pertains to the loan's interest rate. The higher the APR, the more expensive the loan. This affects your monthly payments and whether or not the loan is worth it. Some personal loans may also have a fixed rate, so the interest remains the same during the loan's lifetime. A variable rate means the interest rate can fluctuate. Fixed rates can be more predictable for your budget.

- Loan terms: Loan terms refer to how long you have to repay the loan. This can range from one to 10 years, depending on your lender. Short-term loans will have higher monthly payments but will also incur less interest. Find one that fits your monthly budget.

- Fees: Personal loans come with fees apart from interest. For instance, origination fees are one-time fees for processing the loan and are usually a percentage of the loan amount. The lender can charge this fee upfront or deduct it from the total amount you borrowed. Lenders may also charge other fees, such as prepayment penalties, returned payment fees, and late fees. It's best to go for a lender who is transparent about these fees.

To realistically determine what personal loans you qualify for, you can go through a prequalification process if the lender offers one. During this process, you may learn the loan's APR, terms, and required monthly payments. This information can help you identify if the loan fits your budget.

The prequalification process only requires a soft inquiry on your credit — meaning, the inquiry won't negatively impact your credit scores. However, some lenders will perform a hard credit inquiry during the actual review. A hard inquiry gets reported on your credit report while a soft inquiry does not. Too many hard inquiries can negatively impact your credit score, meaning multiple applications can affect your chances of approval.

2. Gather and Submit the Required Documents

Once you've selected a lender and reviewed potential loan terms, prepare your documents and submit them upon application. Many lenders, like Atlas Credit, offer online applications, but some traditional banks and credit unions may require you to apply in person. You still have to formally apply even if you've prequalified for a loan. Most applications also include a hard credit check.

After the lender reviews your application, they may ask for additional documents, like bank statements or tax returns. Some online lenders may require online access to your bank account to review your history and verify your income and debt payments. You'll learn whether you've qualified for the loan once they've reviewed all the documents you submitted.

For secured loans, your collateral can affect the timeline of the approval timeline. Lenders would have to assess whether the value of the collateral would suffice.

3. Review Your Loan Offer

If you qualify for a loan, you don't necessarily have to accept it. Make sure to review your loan offer and that it still satisfies what you're looking for. You can also connect with the lender's support team for any questions or clarifications. If the terms no longer meet your needs, then you can keep looking for other lenders. However, lenders typically charge nonrefundable application fees.

4. Receive the Funds in Your Account

If you agree to the terms of the offer, you may receive the funds in your bank account within a week. Some lenders may offer same-day funding. Most lenders require a bank account for disbursement and repayment. Repayment usually starts 30 days after approval.

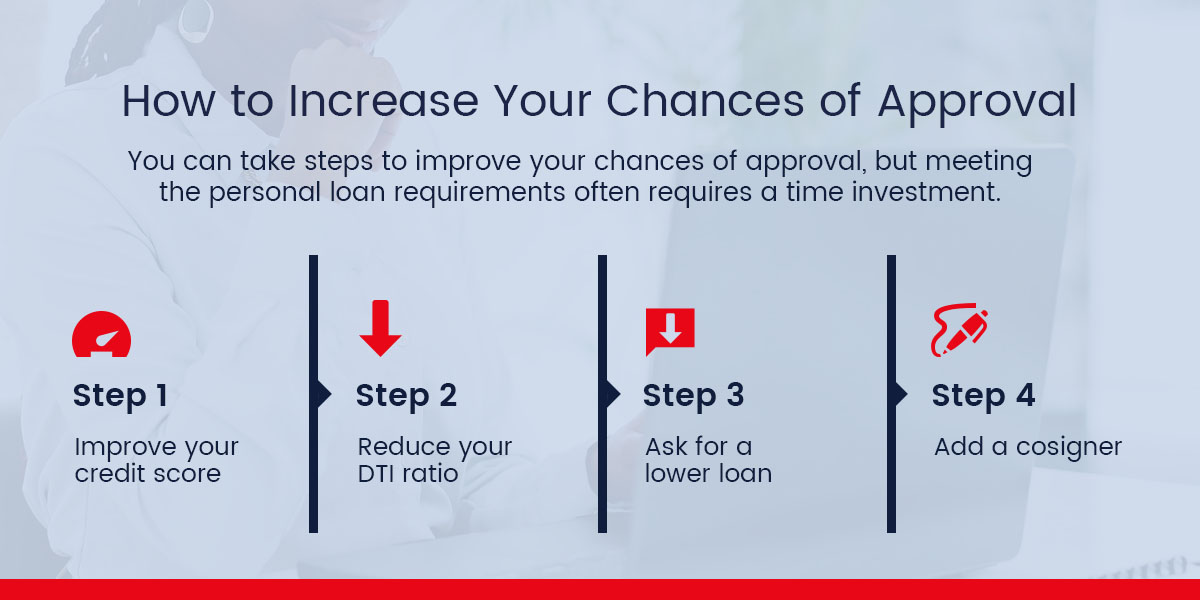

How to Increase Your Chances of Approval

You can take steps to improve your chances of approval, but meeting the personal loan requirements often requires a time investment. Here's what you need to do:

- Improve your credit score: Since credit scores are the primary consideration for many lenders, you can start by improving your credit score before you apply for a loan. Pay your monthly bills on time and regularly check your credit report for errors.

- Reduce your DTI ratio: You can lower your DTI ratio by increasing your income or prioritizing paying off some of your debts.

- Ask for a lower loan amount: In the first quarter of 2025, the average debt per borrower for unsecured personal loans is over $11,000. Asking for a loan amount that's realistic based on your income can increase your chances of approval.

- Add a cosigner: A cosigner with good credit can help you qualify for a personal loan or get better terms. They will be responsible for the loan payments if you can no longer pay them. Cosigners are not coborrowers, so they won't benefit from the loan itself. Cosigners are just there to help you qualify.

Why Trust Atlas Credit

Atlas Credit has been helping underserved communities since 1968. By offering personal loans that don't consider credit scores, we can support people's financial goals and help them improve their credit history as they make timely payments. We offer various personal loans amounts, from $100 to $1,400, so our clients can focus on getting only what they need without worrying too much about interest.

What's more, we are a transparent company. Our clients are fully informed of every detail, such as their required monthly payments, due dates, and the total amount they owe. Whether our clients prefer to transact in person or online, they can count on our storefront locations across Texas and Oklahoma, or our website for places where we are not physically present. Whatever the case, we are here to provide affordable and easily accessible personal loans to those who need them.

Apply for a Personal Loan With Atlas Credit

Meeting the requirements is a good sign that your personal loan will be approved. Some lenders have strict standards, and you might have even been rejected by one of them. Knowing what you need for a personal loan and preparing for it helps. However, if your poor credit is a barrier, you can turn to Atlas Credit for your financial needs.

At Atlas Credit, we believe your credit history should not hinder you from getting a second chance at improving your finances. A lot may have changed in your situation. Plus, life circumstances out of your control may have made it difficult for you to pay off your debts previously. So, instead of using credit scores as our primary consideration, we look at other factors, such as your source of income.

Our personal loan application process is quick and easy. The online application only takes a few minutes. We can even approve your application the same day you apply. If you're ready to get started, apply for a loan today.