For most of us, summer is a time to unwind, connect with loved ones, and explore new places. However, travel costs can add up fast.

The good news is that vacations can stay within your budget. There are many ways to finance your trip and even more ways in which, through careful planning, you can have a great time without breaking the bank. With a plan in place, you can focus on the vacation experience instead of the expense. Here are our best tips for saving money for a trip.

Start With a Financial Plan

The best way to pay for a vacation is with cash, which means you need to start saving money for traveling. How do you save money for a trip? Look at your full financial picture, and start considering the trip in your budget. Confirm your monthly expenses like rent, utilities, and groceries, and then look at how much discretionary income you have after covering the necessities. Do you have any debts or financial priorities to address first? Use a budgeting app, spreadsheet, or pen and paper to break down your current cash flow.

Stay on track by using the 50-30-20 rule, where 50% of your income goes toward needs, 30% toward wants, and 20% toward long-term savings or paying off debt. Your wants category is usually flexible, so you can find areas here to cut back temporarily and start saving money for a trip instead.

Set Your Vacation Budget

Before you start browsing flights and hotel rooms, have a clear picture of what you can afford. How much should you save to go on vacation? Having a plan minimizes surprises and helps you make smarter choices along the way. Set a total vacation budget, and work backward from there. Say you set a $2,000 cap for your family trip. Here is how you can break it down:

- Travel $600

- Accommodation $500

- Food $400

- Entertainment $300

- Unexpected costs $200

Include saving goals that are within your capabilities. With a $2,000 budget, you ideally want to save $125 a week over 16 weeks, but even if you are able to save $50 a week, it is better than nothing. Set up a dedicated vacation savings account. It will simplify tracking your goal, and some products will let you earn interest on your savings, which is an added bonus. Automate your savings with monthly or weekly transfers to help you keep up with this goal and avoid accidental spending.

Cut Unnecessary Expenses

A few short-term sacrifices can yield big rewards as you save money for vacation. Review your monthly expenses, taking note of nonessentials like impulse purchases, daily coffees, food delivery, or subscription services you rarely use. For example, skipping a $6 daily coffee and putting that money into your savings account instead for two months adds $360 toward your trip.

Cutting back means being more intentional about where your money goes. Instead of giving up coffee, brew some at home. Find lower-cost alternatives that still deliver satisfaction and meet your needs. Another budget-friendly swap is to cook in batches and freeze portions. By meal prepping, you can skip dining out a few times a week for convenience, at $20 a meal, potentially saving over $160 a month.

You can also save by reducing driving. Walking or biking to nearby places reduces your gas expenses and is better for the environment.

Track Your Savings-Through-Sacrifice

Committing to change is easier when you can see the impact. Create a visual tracker, whether it is a simple spreadsheet or a jar on your kitchen counter with marbles, as long as it shows how much you are saving for a vacation by replacing high-cost habits.

Use Rewards and Discounts

How do you save money on a hotel? Lean into the power of points and perks. Use your credit card rewards, loyalty programs, and discount apps. This strategy is especially effective when you are already spending responsibly and can combine various perks. Book through a discount site using your rewards credit card, or use gift cards strategically for your trip.

Line up Your Rewards

Take inventory of your existing rewards:

- Credit card points: Check if your card offers cash-back, travel points, or statement credits. Some cards let you redeem points directly from flights, hotel stays, or rental cars through a travel portal. If you are looking for a new credit card, many travel cards offer introductory bonus points.

- Frequent flyer programs: Even occasional travelers can accumulate enough miles for discounts or free checked bags. These programs also give you insight into reduced pricing, seasonal deals, and helpful travel tips.

- Hotel loyalty programs: Chains like the Hilton, Marriott, and Hyatt often offer free nights, upgrades, or free breakfast through their loyalty programs.

- Retail rewards: Major stores offer discounts or cash-back on travel items, like luggage or gear, through their apps or rewards programs. Some rewards programs also give you coupons you can collect from any store and redeem for travel necessities.

Click on Discount Travel Websites and Browser Tools

Comparison is key when you are booking travel. Sites like Kayak, Expedia, and Google Flights allow you to quickly evaluate price options. You can also set fare alerts on sites like Skyscanner or Hopper, which will notify you when prices drop for hotel stays or flights. If the dates or destination of your trips are flexible, you can often find great deals on flights. Some tools and platforms are specifically designed to sniff out hidden savings — browser extensions like Rakuten can automatically apply promo codes or offer cash-back when you book online.

A tip from the pros is to clear your cookies or use incognito mode when searching for flights multiple times. Some travel sites will adjust their prices based on your browsing history.

Look for Member-Exclusive Discounts

For further travel cost reduction, consider the memberships you are already paying for or receive for free through work or credit cards, which come with travel perks. Popular memberships with these benefits include:

- AAA or AARP: These groups offer exclusive hotel, car rental, and attraction discounts.

- Warehouse clubs: Costco and Sam's Club often offer deeply discounted travel packages for their members.

- Alumni associations: Alumni associations, unions, or professional organizations can provide savings on tours, hotels, and even travel insurance.

- Employer perks: Many companies offer employee discount programs for travel, including theme parks, hotel bookings, and airfare.

Compare Staycation Benefits

Have a summer vacation on a budget by staying close to home. If you plan a local vacation, there are countless ways to use discounts and rewards to create an affordable, memorable experience. Most cities offer visitor cards that include entry to multiple local attractions at a reduced cost — some museums also offer resident discounts or free entry days you can use. Many credit cards even offer deals on dining, gas, or rideshares, all useful for city exploration and day trips.

Save on Vacation Costs

Another way to save up for a vacation is with a willingness to be flexible and a few insider tips. With these practices, you can enjoy a memorable trip while keeping your spending in check. From choosing cost-friendly destinations to timing your travel rights and knowing the best booking windows, here is how you can cut on expenses and save money while traveling:

Smart Destination Choices

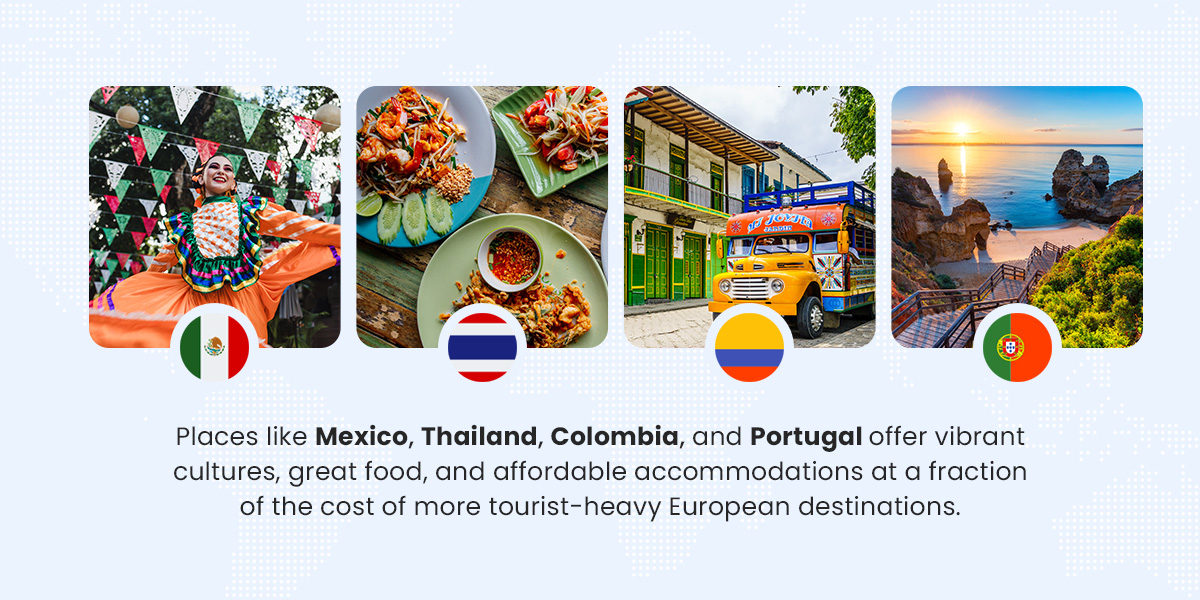

If you are traveling internationally, go where the exchange rate works for you. Look for countries where the U.S. dollar is strong. Places like Mexico, Thailand, Colombia, and Portugal offer vibrant cultures, great food, and affordable accommodations at a fraction of the cost of more tourist-heavy European destinations. Alternatively, consider more affordable destinations closer to home. You can find plenty of under-the-radar gems like:

- Quebec City, Canada: By going abroad without going too far, you get to visit a UNESCO World Heritage Site, enjoy the great outdoors, and support sustainable travel and tourism practices.

- Asheville, North Carolina: In Asheville, you can enjoy craft breweries, mountain scenery, and a beautiful historic district with houses dating back to the 1890s.

- Grand Rapids, Michigan: Find beaches, art, and low-cost lodging in Grand Rapids. There are also various museums, flea markets, and escape rooms that pique your interest.

- Tucson, Arizona: You can enjoy gorgeous desert hikes, adventures at the Arizona-Sonora Desert Museum, and affordable resorts to rest in at the end of a fun day.

State parks, national forests, and scenic byways offer affordable adventures. Camping, hiking, and swimming provide all the relaxation and excitement of a vacation minus the price tag of airfare and hotels. Look for state park cabins or yurts, which provide comfort without hotel costs.

Best Time to Travel

When you travel can be just as important as where. Traveling midweek or during shoulder seasons like late May or early September can cut your travel costs by up to 25% when you travel from the U.S. to Europe on particular routes. Use Google Flights' price graph tool or Hopper's app to visualize airfare trends by day.

Optimal Booking Period

Booking early can lock in low prices, especially on flights. But last-minute deals are also an option if you have a flexible schedule. Apps like HotelTonight or LastMinute.com offer discounted same-day bookings that can cut hundreds from a trip. For domestic flights, book one to three months in advance. For international travel, book two months out for near international travel — such as the Caribbean or Mexico — and two to six months out for European travel.

For hotels, the best day of the week to book is Friday for domestic and Thursday for international stays. Booking one to two weeks before your stay will yield an average savings of 8%. If you are willing to wait and book the week of your stay, you could save up to 21%. Rental rates will be higher during the popular visiting months, with the lowest rates during the shoulder seasons, often early spring or late fall. Start your search in the middle of the month before your intended stay.

Smart Food and Accommodation Strategies

Your daily expenses can add up quickly, even after booking lodging and travel. Here are some money-saving travel tips:

- Prepare meals on vacation: Look for lodging with kitchens like Airbnb rentals or extended-stay hotels so you can prepare meals yourself instead of dining out every day. Grocery shop when you arrive, and pack a picnic for sightseeing days.

- Look for free food options: Many hotels offer free breakfast, and you can find kids-eat-free promotions at certain restaurants.

- Share costs with family or friends: Vacation with a group to split costs for lodging, groceries, and transportation.

- Use public transit: Skip the rental car when it is not essential. Public transportation is affordable and reliable in cities like Portland and San Francisco. Better yet, explore neighborhoods on foot or by bike — it is free and often more memorable.

Seek Free or Low-Cost Entertainment

When it comes to vacations, experiences matter more than expenses. You can actually save on vacation. From catching a sunset concert in the park to exploring local art districts, some of the best vacation memories can come from moments that cost little or nothing. Start with the local tourism boards and visitor centers. These organizations often promote local attractions, walking tours, festivals, and events, many of which are free or deeply discounted. You can usually find printed maps or booklets with coupons like two-for-one admission deals to local attractions.

Natural beauty is one of the most accessible forms of entertainment. Many state and national parks offer free entry on certain days, and beaches or lakes only charge parking fees for a full day of relaxation. Some towns organize free events during the summer to attract tourists and unite the community. Follow the social media pages of city councils and community groups so you can see these events before they hit major tourism sites.

Use Travel Apps

Many cities offer a City Pass that bundles admission to multiple attractions for a reduced price. While not free, it is a cost-effective way to experience a lot in a short time, helping you save money and travel. Several apps and websites help travelers find affordable or free things to do:

- Eventbrite and Meetup: These platforms list public events, workshops, and social gatherings in various cities.

- AllTrails: If you enjoy hiking, this one is for you. AllTrails helps you find local hiking trails based on difficulty and user reviews.

- Culture Trip: You can uncover those hidden gems with Culture Trip and Atlas Obscura in every city, many of which are free.

- Goldstar: With Goldstar, you can get discounted or comped tickets to live shows and performances in select cities.

Learn to DIY Fun

Impromptu or do-it-yourself (DIY) fun can create some amazing vacation memories. Think hosting a sunset beach picnic, organizing a game night in a rental home, stargazing in a rural spot, or following a self-guided food tour. For example, in Hershey and Harrisburg, Pennsylvania, you can sign up for the Sweet Treat Trail, which is free. At your own pace, you browse local family-owned shops and earn 50 points for each purchase. When you reach 300 points, you get a prize.

Tap Into These Top Tips

True travel success is in the details. The small steps you take before you pack your bags can be just as impactful as where you decide to go or when you choose to book. From protecting your investment to turning clutter into cash, here are bonus strategies to help you stay on track and return home financially refreshed.

Milk the Last Day

Ending your trip on a high note ensures you come home feeling more refreshed, so some people believe in saving the best for last. This strategy can mean going out for a great dinner, saving your last night or two for more high-end accommodation, or finding a fun activity to splurge on before heading home.

Drive Instead of Flying

Driving instead of flying when feasible, especially for family trips, can save on commute costs. Rent a fuel-efficient vehicle, or stay closer to home and drive your car to reduce travel spending.

Get Travel Insurance

Even when funds are limited, travel insurance is worth considering. An unexpected cancellation, medical emergency, or delayed flight can otherwise mean losing the money you worked so hard to save. Some credit cards offer travel protection as a benefit when you use them to book your trip, so review your cardholder perks before purchasing separate coverage.

Sell Unwanted Goods

Boost your budget by selling unwanted items and putting the proceeds into your trip savings account. Here is where you can start:

- Clothes and accessories: Try Poshmark, ThreadUp, or local consignment stores.

- Gadgets and electronics: Use eBay, Facebook Marketplace, or Gazelle to sell these items.

- Household items: Books, games, and household items are great for garage sales or neighborhood swap groups.

Stay Motivated While You Save

Saving for a trip can take weeks or months. Staying motivated is key to making it to the finish line without dipping into your other savings or giving up altogether. Visualize your goal through photos in high-traffic areas, track your progress with a paper chart or budgeting app, and set milestones to celebrate small wins like reaching your halfway savings goal with a budget-friendly treat.

Consider Alternative Financing Options

Even with disciplined savings, some vacations may still feel out of reach. If you plan a once-in-a-lifetime trip, celebrate a milestone, or simply need flexibility, a low-interest personal loan can help bridge the gap. You enjoy fixed interest rates and fixed monthly payments, have a clear payoff date, do not need to offer any collateral, and will have your funds within a few business days.

Here is how to determine if a personal loan is the right solution to fund your vacation without compromising your financial health:

- You are traveling for a once-in-a-lifetime event.

- You can afford monthly payments without strain.

- You want to avoid overspending on high-interest credit cards.

- You prefer a defined payoff timeline.

How to Use a Personal Loan

If a personal loan is the right choice for you, it is essential to use it wisely. Borrow only what you need, shop for the best rates, and stick to your budget by using funds only for the intended travel expenses. If your savings alone fall short, a personal loan can be a smart, manageable solution. Choose a lender that helps you understand repayment terms clearly and works with your financial goals.

Why Trust Us

At Atlas Credit, we believe in flexible, transparent financing that empowers our customers, not burdens them. We have supported customers and their families since 1968 and have over 50 locations across Texas. We offer affordable credit and personal loans, with repayments created to suit your financial means. Partnering with us gives you:

- Easy loan application: You can apply for a loan in three easy steps and eSign your loan document on approval to complete the process.

- Quick turnaround time: You are assured of quick turnaround times for credit decisions for your convenience.

- Additional support: You can sign up for Atlas Protect to help you understand your credit score as you work toward your financial goals.

Fuel Your Vacation With Atlas Credit

Budgeting for a vacation means you can enjoy your time away without the guilt or pressure of overspending. Even when you know how to save money for travel, you might fall short. And if your dream trip still feels out of reach, consider combining your savings strategy with a low-interest personal loan for larger travel plans.

Fill the gaps in your vacation savings with an Atlas Credit loan of up to $1,400, and enjoy your trip. As a trusted lender, we offer transparent, affordable loans tailored to your needs. These can help cover your travel costs, lodging, and other expenses without relying too much on high-interest credit cards or dipping into your emergency savings.

Apply online today, or visit one of our locations in Texas, Oklahoma, and Virginia for in-person assistance.