Setting a budget is the first step in making your financial goals a reality. Whether you are interested in paying off personal debts or saving up for a fun new purchase, having a budget will help you track exactly how you will use your money. With the structure of a budget, you can make the necessary spending adjustments that will push you closer to your desired results.

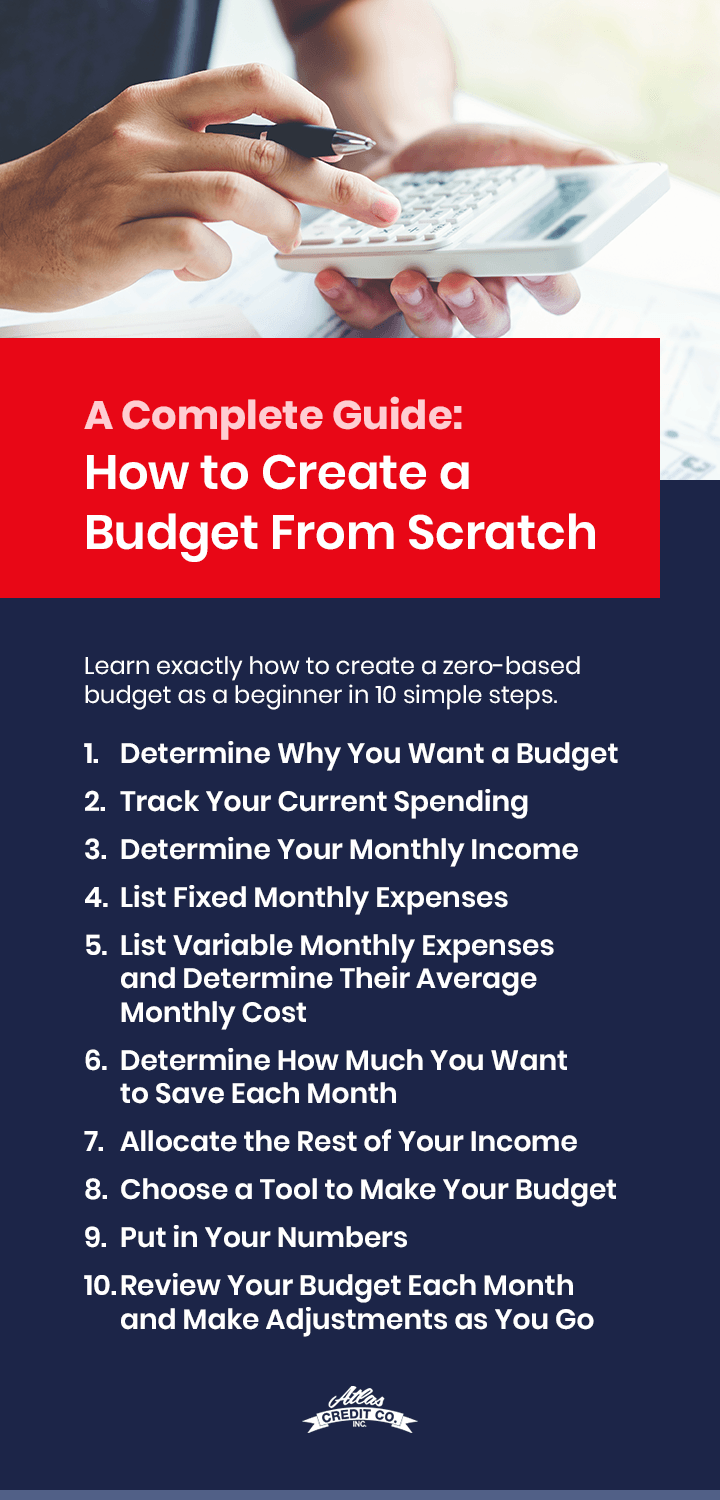

Understanding how to start a budget from scratch will save you both time and stress. That's why we've created this guide on how to make a budget. Learn exactly how to create a zero-based budget as a beginner in 10 simple steps.

Step 1: Determine Why You Want a Budget

You might want to start paying closer attention to your money for many reasons. The first step in our budget guide for beginners is determining why you want to start a simple budget.

Ask yourself why you want a budget and what goal you want to reach. Do you need to create one out of necessity? Are you looking to get your finances more organized? Are you trying to save for a specific purchase or vacation? The following are some common reasons why you might want to start tracking your finances for a budget:

- You want to work on getting out of debt.

- You are interested in setting aside money for savings.

- You want help changing your poor spending habits.

- You have long-term financial goals you want to meet.

- You are looking to get through a financially tight time.

- You are interested in getting your finances organized.

Once you understand the reasons why you want a budget, you can start prioritizing your banking needs. Creating and sticking to a budget will give you structure and keep you on track for meeting your goals. No matter your reason for wanting to know how to start a budget plan, following along with these steps to create a budget will help you find your way.

Step 2: Track Your Current Spending

Did you know 65% of Americans do not track how much money they spend each month? Meanwhile, 59% of American adults are living paycheck to paycheck. If you are relying on your next paycheck to get you through the month, you must understand where every dollar is going in order to maintain financial security.

This is why the next step in budgeting basics is tracking your current spending. The idea is to understand where your money is being spent and how much you are spending. Being aware of your spending is a huge part of budgeting for beginners.

Part of maintaining a budget is finding systems that you can stick to and that work for you. You can track your spending in numerous ways. No one way is better than the others, but some methods will definitely save you time!

Track by Hand

One way to track your spending is to track it by hand. If you prefer this method, make a detailed list of purchases and expenses for the month. While this system is not the most efficient way to track your finances, writing a list by hand requires no tools or software.

One of the advantages of tracking by hand is you can write down your list whenever and wherever you want. If you make payments in cash, you can easily track those by hand as well.

Go Through Your Bank

Some banking institutions have tracking capabilities that do the work for you. For example, if you do your personal banking with PNC, you can apply for PNC Virtual Wallet to access digital tools that track your expenses. Ask your bank if they offer tools that can simplify the process.

Tracking through your bank is a great way to keep an accurate account of your expenses without manually tracking where your money is going. Often, banks have mobile phone apps that make accessing your information super convenient. Anytime you have your cell phone, you can track your expenses.

Try a Management Tool

Tons of online tools can automatically record outgoing purchases from your bank account. These resources are often free or charge a small monthly fee. Mint, also known as Intuit Mint, is a great example of a free management tool that you can use for tracking your spending.

These tools link up to your bank account and record outgoing payments that you can access later. Like tools provided by your bank, these tools often have mobile phone apps that keep your expenses at your fingertips and all in one place.

Use Credit Card and Bank Statements

Using credit cards or bank statements is a fantastic way to track your expenses. Looking at these statements will help you take inventory of exactly how much money is going in and out of your various accounts. Keep these statements filed somewhere safe so you can refer back to them when you need to find monthly averages later.

Step 3: Determine Your Monthly Income

Once you have found a preferred method to track your current spending, it is time to take the next step and determine your monthly income. This is an important step in how to make a monthly budget since the rest of your financial goals will depend on how much money you make each month.

When determining your monthly income, you must consider taxes. Your monthly income will encompass the amount of money left over after deducting all taxes. Let this be a friendly reminder not to include untaxed income accidentally. This will make the rest of the steps in your budget plan inaccurate and you do not want to spend money you owe on taxes accidentally.

When determining your monthly income, consider every one of your revenue streams. For some people, this number includes only the money they receive from their regular paychecks. For others, monthly income could include a number of different payments. You might receive child support payments, alimony payments or earnings from investments on a monthly basis. Count every stream of income.

Step 4: List Fixed Monthly Expenses

Having a detailed list of your monthly expenses is a great budget tip for beginners. Keep a list of your fixed monthly payments to refer back to later. Fixed expenses are not the same as regular expenses. Instead, fixed expenses encompass the reoccurring bills that cost you the same amount every month. Some common examples of fixed monthly expenses include:

Rent payments

- Student loans

- Phone bills

- Gym or fitness memberships

- Internet access

- Cable plans

- Insurance premiums

- Streaming subscriptions

- Application subscriptions

- Car payments

- Bank fees

Take inventory of all these expenses. If you are looking to cut down on spending, see if you can do any refinancing or cancel any subscriptions to reduce these costs. Plus, having them listed out will help you stay organized and on top of your payments.

Another great tip for beginner budgeting is to use the "bill pay" feature available in your checking account. Some banks offer these settings as part of your account. Bill pay allows you to send electronic payments over the internet seamlessly. Once you turn on the bill payment functionality through your bank institution, your bills are paid through monthly automation.

This setting saves you the stress of paying each bill individually, and you will not have to worry about remembering to make a payment on time. Bill payment settings keep your monthly payments highly organized while doing the work for you.

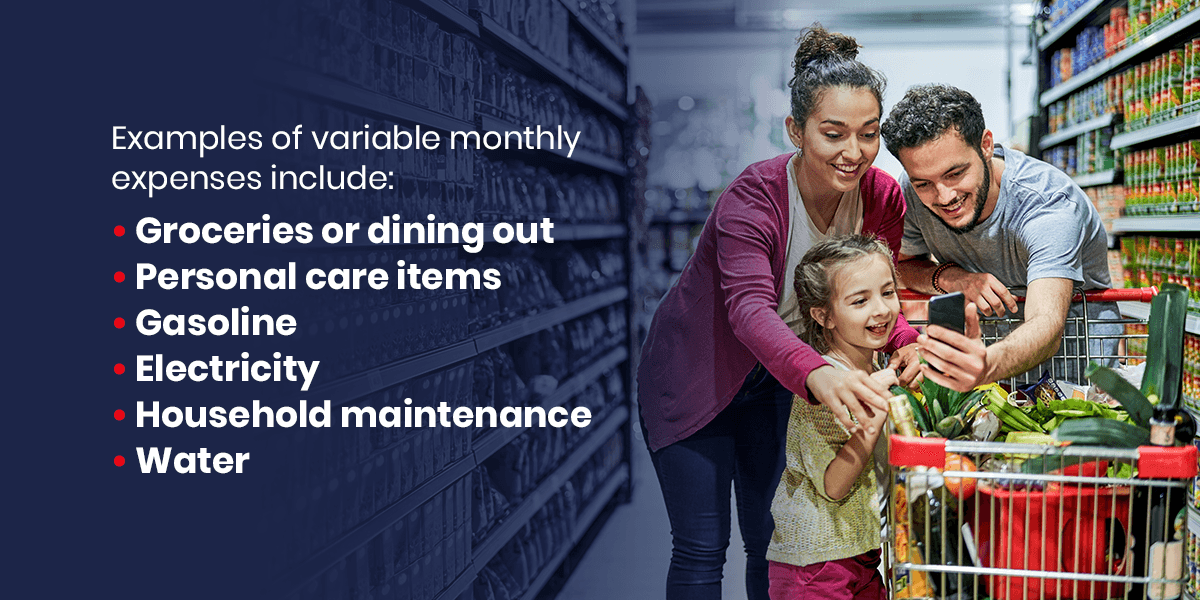

Step 5: List Variable Monthly Expenses and Determine Their Average Monthly Cost

Variable monthly expenses are reoccurring costs that vary from month to month. Examples of variable monthly expenses include:

- Groceries or dining out

- Personal care items

- Gasoline

- Electricity

- Household maintenance

- Water

Variable expenses may cost you a slightly different amount each month. This is due to changes in behavior like water usage or changes in rates such as gas prices. These charges will change monthly but should still stay within a reasonable range, allowing you to estimate your average costs. You can choose your goals based on your living expenses.

Once you have all your variable monthly expenses recorded, make a list of how much each has cost you over the last few months. Because these expenses will fluctuate, you will need to find the averages. Calculating the averages will help you allocate the right amount of money towards your expenses.

For example, you might have spent $100 on groceries in June. Then, in July, you might have spent $88. And in August, let's say you shelled out $105. You would record these three amounts and then add them up and divide them by three months. This will give you the monthly average cost of your groceries. In this case, you hypothetically spend an average of about $98 on groceries each month, and this is the value you would note when listing the monthly expense of groceries.

Step 6: Determine How Much You Want to Save Each Month

Whether you are saving for a rainy day or for your retirement fund, having a nice cushion of savings can ease your money stress. Savings typically fall into one of two categories. The first is goal-oriented savings, and the second is savings for unexpected expenses. You will likely have to save some of your income for both categories.

Understanding the ins and outs of these savings categories will help you figure out how much of your money you should put away for safekeeping every month.

Goal-Oriented Savings

Anytime you are saving a specific amount of money for a specific purpose, you're using goal-oriented saving. When dealing with this category of savings, the money you retain will be left untouched until you are ready to spend it on your goal. That means for an amount of money to be considered part of your savings, you should not dip into it for any purpose other than an absolute emergency. Some examples of savings that are goal-oriented include:

- Retirement funds

- Vacations and trips

- Down payments on houses or cars

- Education and tuition

A perk of goal-oriented savings is that you will have a pretty good idea of just how much money you will need to save for each milestone. You can keep a record of exactly how much money you have saved versus what you need. The same is not necessarily true of unexpected and irregular expenses.

Savings for Unexpected and Irregular Expenses

While you cannot plan the unexpected, you can be prepared when something unusual happens in life. Having savings specifically for irregular and unexpected expenses is a great practice to lessen your stress when something goes awry. Factor in savings for occasions that pop up unexpectedly or rarely. The following are some examples of irregular expenses:

- Veterinarian bills

- Car maintenance

- Vehicle registration

- Quarterly tax payments, if applicable

- Appliance replacement or repairs

While you probably do not plan on your dog needing treatment for an ear infection or your car getting a flat tire on the highway, you can plan on having some money set aside for these kinds of unforeseeable costs. Another note about irregular expenses is that while these are not as regimented as fixed expenses, you should still plan on having to afford these things.

Quarterly payments such as property taxes and other costs that pop up periodically throughout the year should be noted as planned expenses. While you might be crafting a monthly budgeting plan where you do not have these types of payments shortly, it is still vital that you remember to factor in the costs of quarterly or bi-annual expenses into your monthly savings systems.

Figuring Out How Much You Can Save

Everyone would love to rack up their savings! Realistically, however, you will need to think about your expenses first and your savings second. Once you have your monthly income determined, you can start the process of configuring how much of your money you can afford to put into your savings each month.

To figure out just how much you can save each month, combine both your fixed and variable expenses. Once you have the sum of all your monthly costs, take that figure and subtract that amount from your monthly income. The number you get will reflect the largest amount of money you can put into your savings each month. Take this as a friendly reminder that saving even a small amount of money each month will be beneficial to your future.

Step 7: Allocate the Rest of Your Income

Now for the fun part! After factoring out all your expenses and savings, you are left with some remaining money. You can spend this leftover money on whatever you want. After making sure you have your expenses covered and money allotted to your savings, you can divvy up what you have left and use that money for doing the things you enjoy. Some people use the rest of their income on shopping or eating out.

When you carefully follow your budget, you do not need to feel guilty about spending money on pleasure, recreation, or entertainment. While you designated this money specifically to treat yourself, this is also the first category from which money will be reallocated if your budget needs tweaking.

Step 8: Choose a Tool to Make Your Budget

You have everything sorted from income to expenses. Now it is time to put the budget together in one streamlined place. Choosing the right tool is essential when determining how to start a budget when you are already behind. Thankfully, you can use tons of helpful online tools for making your budget. These resources will help you keep track of your budget every month:

- Microsoft Excel: If you like spreadsheets, Excel is an excellent resource for making a budget. You can customize and edit the sheet as needed. You can even connect your bank account to Excel to make budgeting even simpler. You'll find both free and premium options for Excel budgeting templates you can download online that will help keep you organized.

- Google Sheets: Much like Microsoft Excel, Google Sheets allows you to customize spreadsheets so you can keep your budget organized. One of the best parts about using this management tool is that you can access your budget from anywhere with the free mobile app. Using Sheets is entirely free for personal use as well.

- Mint by Intuit: Mint offers an online budget planner. It is completely free, and you can manage all your accounts in one place. You can also set specific spending limits and get notifications when you overspend. Mint offers personalized insights and free credit scores. Plus, their bill and subscription payment tracker will keep your automated expenses organized so you can see what and when you are being charged.

- You Need a Budget: You Need a Budget, also referred to as YNAB, is an app for tracking your spending that costs just under $12 every month. Whether you have an iPhone or Android or prefer to do your budgeting from a desktop computer, You Need a Budget will help you track your money from anywhere with internet access.

- PocketGuard: If you are interested in having a management tool that helps you find and negotiate lower monthly costs, PocketGuard is a great option. If you struggle with overspending, PocketGuard can help send notifications to keep you within your budget. This app has both free and premium options.

Step 9: Put in Your Numbers

You have collected all the numbers you need to make a budget sheet. Now, it is time to plug those figures into the tool of your choice. Once your budget is organized, you can analyze how and where you spend your money all in one streamlined place. You can access your budget whenever you need it and track any changes.

You can experiment with different budgeting tools and find which one works best for you. Taking the simple steps to create a successful budget plan means finding the right methods to keep you on track.

Step 10: Review Your Budget Each Month and Make Adjustments as You Go

Make it your mission to revisit your budget every few weeks. Plan on updating expenses or income if any changes occur. By keeping a close eye on your budget, you can find the areas where you can cut down on spending.

For example, you might find that you are paying for a subscription you are no longer interested in. You can spot this on your budget and cancel it. Once you make the change, go back into your budget and update your expenses. This may free up extra money for savings or personal spending. Reviewing your budget regularly is an excellent practice for beginner budgeters. It allows you to be accountable and responsible with your finances.

Enjoy the Benefits of Your Budget

We understand it can be challenging for beginners to know how to start a budget. Fortunately, by following these 10 steps and our budget tips for beginners, you will have a highly organized and easily accessible plan that will set you on the path towards meeting your financial goals.

Once you have a grasp on budgeting, you can focus your attention on other aspects of your financial well-being. Atlas Credit can help! No matter where you are in your fiscal journey, Atlas Credit provides an easy online option for personal loans, even if you have poor credit. Learn more and apply for a loan now with our secure online application.