Taking out a personal loan can help you access cash in unexpected circumstances. Perhaps you have a medical expense or a pipe burst in your home — a personal loan may be your solution if you don't have cash on hand.

Before getting a personal loan, you may wonder if loans affect credit scores. Yes, a personal loan can positively and negatively impact your credit score. The most significant impact is how you handle your payments. Knowing the benefits and risks before you apply is important — keep reading to learn more.

What Is a Personal Loan?

A personal loan is a loan that you can use for almost anything. Some common reasons people take out personal loans are to start a business, pay medical expenses, plan their wedding, or for an emergency like fixing a leaking home roof.

Some individuals even use a personal loan to pay off credit card debt or other high interest rate debt — known as consolidating debt. This is because personal loans often carry lower interest rates than credit cards. A personal loan is an unsecured debt, meaning you don't have to put down collateral when applying. Therefore, the interest rate will be higher than a home or auto loan, which requires collateral.

You can get a personal credit loan from a bank, credit union, or online lender. Besides interest, some lenders will charge a fee for a personal loan. As long as you have a good credit score, you should be approved for a personal loan within a few days of your application. The loan terms will also depend on your credit score.

How Are Credit Scores Calculated?

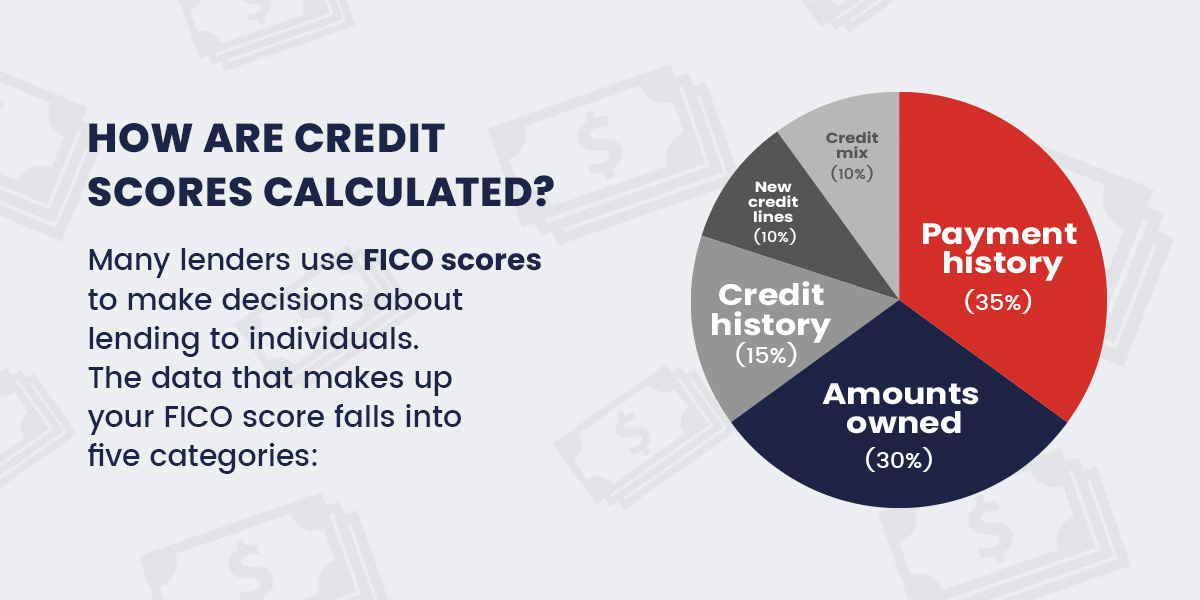

Many lenders use FICO scores to make decisions about lending to individuals. The data that makes up your FICO score falls into five categories:

- Payment history: Payment history is 35% of the score and the most important factor of the score. It tells lenders whether you have paid your past credit accounts on time. Using this information, they can assess the risk they are taking on when they lend you money.

- Amounts owned: Amounts owed make up 30% of your FICO score. Owing money doesn't necessarily mean you are a high-risk borrower with a low credit score. However, if you have many lines of credit, it may indicate that you have overextended yourself and are at risk of defaulting.

- Credit history: The length of credit history is 15% of the score. Generally, having a longer credit history contributes to a positive FICO score, but it is not necessary for a good credit score. FICO scores also take into account how long you've had your credit accounts and how long it's been since you've used them.

- New credit lines: New credit lines account for 10% of your score. Opening multiple lines of credit in a short period poses a greater risk to lenders, especially if the person has a shorter credit history.

- Credit mix: Credit mix is the type of credit lines you have — retail accounts, credit cards, mortgage loans, or auto loans. You don't need to have one of each, but lenders do assess your ability to manage different types of credit. Credit mix makes up 10% of your FICO score.

How Does a Personal Loan Affect Credit Score?

Does a personal loan hurt your credit? Much like any other line of credit, a personal loan will affect your credit score in good and bad ways. Taking out a personal loan is not a bad thing. It's how you manage it that makes a difference to your score. Late payments can damage your score, whereas if you pay on time, you can boost your score.

Applying for Personal Loans Could Cause Temporary Decreases

So, how are personal loans bad for credit? When you apply for a personal loan, lenders run a credit check. This triggers a hard credit check on your credit report, affecting your credit score. Too many hard credit checks can knock roughly five points off of your score, affecting new credit. A hard inquiry stays on your credit report for two years but will only affect your score for a year.

Credit agencies also take note of this new financial activity. For example, if you take a personal loan and try to take out an auto loan shortly after, creditors may reject you because you already have as much debt as you can handle.

Your overall credit history carries more weight than a single new line of credit. If you have a long history of making on-time payments, the impact on your credit score may be lessened when you take out a new loan. The best way to keep your score from dropping is to ensure you meet payments on time and within the loan agreement.

Missing Payments Will Hurt Your Credit Score

On-time payments are one of the most significant factors contributing to a good score, so it's no surprise that missing payments will affect your payment history and lower your credit score. Even if you have excellent credit, missing a payment by more than 30 days can greatly damage your credit score.

Typically, creditors report late payments after 30 days, 90 days, 120 days, and 150 days — after that, it is charged off because of server delinquency. Missing a payment won't hurt your credit score as long as you pay within the 30-day mark of missing it. The most damage may be paying a late fee. You must pay the full amount to avoid a blip on your credit report. While making a partial payment may seem like good faith, it won't help you avoid hurting your credit score.

If you are past 30 days late, bring your account into good standing as soon as possible. Missing 30 days is bad, but missing 60 days, 90 days, or more will do even more damage. The sooner you catch up, the better.

A late payment can stay on your credit report for up to seven years from the date you missed the payment. The impact on your credit will fade away over time.

Consistent and On-Time Payments Will Boost Your Credit Score

When you make payments on time, you send positive signals of creditworthiness and create a good payment history. Paying on time indicates to credit bureaus that you can take out a loan and pay it back. Paying your personal loan on time isn't the only factor that affects your credit score — you need to pay all your bills on time, such as utilities, student debt, and credit cards.

If you know you will forget to pay on time, it's wise to set up automatic payments or reminders to pay. Creating a monthly budget will also help you manage your money to ensure you have money to pay off your debt.

Apply for a Personal Loan From Atlas Credit

Should you get a personal loan? When you need money for an emergency or to pay off other expenses or debt, a personal loan can give you access to the funds you need. How you manage your personal loan will determine how it affects your credit score. Paying on time and in full will create a positive payment history and boost your creditworthiness.

At Atlas Credit, we simplify the application process by making it easy for you to apply for a personal loan online in just minutes. Once approved, you can eSign your application documents. Need access to funds? Learn more about our online personal loan application today!