Have sudden health issues arisen that have forced you or your family members to visit a doctor or rush to the emergency room? Are you struggling to pay back the medical debt you owe?

Medical bills can be seriously expensive these days. But because your and your family's health is so important, it's hard to avoid sinking into debt to maintain that health. In fact, nearly half of Americans are in healthcare debt.

If you want to better manage your healthcare debt and expenses, here are our tips for budgeting for healthcare expenses and reducing your medical debt.

Why Health Care Budgets Should Be a Priority

It should not come as a surprise to learn that Americans spend a substantial amount on out-of-pocket health care costs each year. Between copays, high deductibles, and policy premiums, average monthly medical expenses continue rising. According to one study, U.S. healthcare spending rose nearly $1 trillion from 2009 to 2019, and recent years have been even worse, largely due to COVID-19.

While it may seem sufficient to go with the flow and pay as things come up, it is not the ideal way to prepare for medical expenses. With healthcare costs reliably increasing, it's essential to be financially prepared for checkups, prescriptions, medical emergencies, and more.

In your budget, medical expenses should take the same priority as food, transportation, and rent. Instead of thinking of health care budgeting as a "nice-to-have" item, you should consider it a must-have. Unfortunately, many Americans skip going to the doctor because they believe they can't afford it. In 2022, 38% of Americans said they or their family skipped medical care due to cost.

How to Create a Health Care Budget

When budgeting medical expenses, start by breaking them down into three primary categories.

1. Fixed Premium

The fixed premium is the amount you pay every month to keep your health insurance instated, either through the federal Affordable Care Act or your employer-provided plan. If your employer deducts health expenses from your paycheck, it's wise to check with them to see what options are available.

2. Routine Expenses

The money you budget here will go toward things you generally expect. Consider maintenance prescriptions, copays for annual checkups, and any other predictable types of medical expenses. Though the price of these can fluctuate, looking at what you've paid in the past will give you a foundation to start with. You can always figure out how to add to it.

3. Unexpected Expenses

Medical emergencies such as household accidents can happen without warning, especially if you have children. Save money for unplanned emergency room trips or urgent medical procedures.

When planning for these expenses, it can be challenging to figure out the right amount to save. Start by reviewing your insurance receipts, bank, and credit card statements. You can also contact your healthcare providers and insurance company for documentation of last year's expenses. Once you have this information, add up any out-of-pocket costs over the past year and use that as your starting amount to save.

You should also be sure to add some wiggle room for future costs. For instance, maybe your doctor has scheduled you for a screening or surgery you did not have to worry about last year. Or, perhaps you would like to start or expand your family. You can always learn more about how much your policy covers and what you might owe out of pocket by speaking with an insurance company representative about your plan.

Emergency Funds

You never know when an accident may happen, and it could cost you a pretty penny. According to a Federal Reserve Board report, in 2018, one-fifth of adults had major, unexpected medical bills to pay, with the median expense between $1,000 and $4,999.

These sobering statistics paint a clear picture of the importance of setting aside money for surprise medical expenses.

Ideally, your emergency medical fund should be enough to cover all your living expenses for three to six months, in case you can't work. It is understandable if that number seems unrealistic to achieve all at once. A recommended starting point is to have at least $1,000 available.

When you start your emergency medical fund, consider setting a target savings goal based on the maximum amount you would pay out of pocket after insurance. Save this amount regardless of whether you live alone or have a family to support. If you have a chronic illness requiring ongoing care, increase the total savings goal amount.

Different insurance companies offer varying insurance plans, so read the fine print to understand what your specific plan covers. In some instances, if you've received emergency medical attention from an out-of-network provider, your insurer might not reimburse you. Consider this when you are budgeting for unexpected health expenses.

Different Health Savings Tools

What percentage of income should go to health insurance? Ideally, you should try to save between 5 to 20% of your income for health expenses. Saving for health expenses doesn't have to be overly complicated. Learn about some of the most popular ways to help you budget in this area.

Health Savings Account

When planning your health care budget, a health savings account is an excellent way to start. Health savings accounts are FDIC-insured, which protects your nest egg if the bank fails. Not only that, but your savings will have the chance to grow with interest. It can be a challenge to save much money when you are already on such a tight budget from other priorities and expenses. However, a savings account will allow you to put away small amounts at a time and watch interest accumulate gradually. You can also receive contributions to your HSA through your employer and roll over funds from year to year.

Flexible Spending Account

Flexible spending accounts are probably the most convenient way to place money into savings for health needs. When you choose to save with a flexible spending account, you can opt to withhold a specific amount of money from each paycheck and deposit it directly into your qualifying account. Either you or your employer can make contributions. However, the law prohibits employer contributions from exceeding a maximum amount. FSAs also have a downfall in that the amounts saved do not roll over at the end of each year.

Health Reimbursement Arrangement

This savings method differs from the previous two because your employer controls the account, and you cannot add money yourself. You are only allowed to spend the money on predetermined medical expenses. One of this plan's benefits is that you can roll over any existing savings to the following year. However, if you leave the company, the funds do not go with you.

Paying off Medical Debt with Personal Loans

Another solution for your boosting your healthcare budget or paying off existing debts is a personal loan. Atlas Credit allows you to apply immediately online, so if you find yourself in a sudden medical emergency and unable to pay the costs to go to the doctor's office or emergency room, you can rest assured you'll be able to pay it.

Personal loans are not like payday loans, which require quick repayment. Instead of having to turn around and pay the loan back by your next paycheck at a high interest rate, you can take your time to pay back the loan at your own pace.

Personal loans are not like title loans, where you place your vehicle as collateral for the loan. Instead, all you must prove is your ability to repay the loan, and you can get one even if you have bad credit!

Apply For a Personal Loan Online

How to Use a Personal Loan to Pay for Healthcare Costs

If you want to take out personal loans for medical expenses, you can rely on these tips to help you navigate your procedures and the financial aftermath.

1. Use Your Loan to Cover More Than Hospital-Related Expenses

In addition to paying for your hospital bills, you may need to finance other things, such as the cost for a spouse to stay at a nearby hotel. Personal loans have no limits on how to use them. You may put part of the loan toward paying a physician for treatment and the other part toward getting medicine from your pharmacy. You determine how to put your loan to work.

2. Negotiate the Cost of the Bills With Your Healthcare Provider

A hospital or doctor's office probably won't negotiate a payment with an insurance company. But if you approach them with a personal appeal, they may be more apt to consider your request. Even if you just get a few hundred dollars knocked off the bill, that's a lot less you have to borrow.

3. Avoid Using Your Credit Card

Once you've figured out how to get a loan for medical expenses, you may still have other costs you need to pay while you are out of work or recovering. You may feel tempted to charge your medical bills, but resist that urge. The more debt you rack up, the longer it will take to repay. Cut extras out of your budget for the next few months and concentrate on paying down your loan.

4. Get Your Funds Quickly

One great advantage of using a personal loan as financing for medical procedures is that you can get your money fast. In fact, sometimes you can fill out an application and collect your cash on the same day when you apply through Atlas Credit.

You will appreciate this flexibility because most medical procedures can't wait. When you need surgery or treatment for a broken bone, you need it immediately. Knowing that you can get your cash fast can set your mind at ease. You already have a lot to worry about for your recovery. When you use a personal loan for medical expenses, you avoid adding one more thing.

5. Stick to Your Repayment Schedule

You will get a firm schedule for repaying the loan, and you should make these timely payments each month. You will even improve your credit score when you pay consistently.

According to the Consumer Financial Protection Bureau, more than half of the debt listed on most credit reports comes from medical bills. In other words, if you're reading this and have debt, there's a good chance that debt is the result of an illness or injury.

So, if you live in the state of Texas or in Oklahoma, you're in luck! You have access to the personal loan services from Atlas Credit, a trustworthy lender offering flexible repayment plans and loans of up to $1,400. Such a boost to your finances can help you get through any tough time, and relieve the stress of immediate repayment. Visit one of our locations in OK or TX, or fill out our online application.

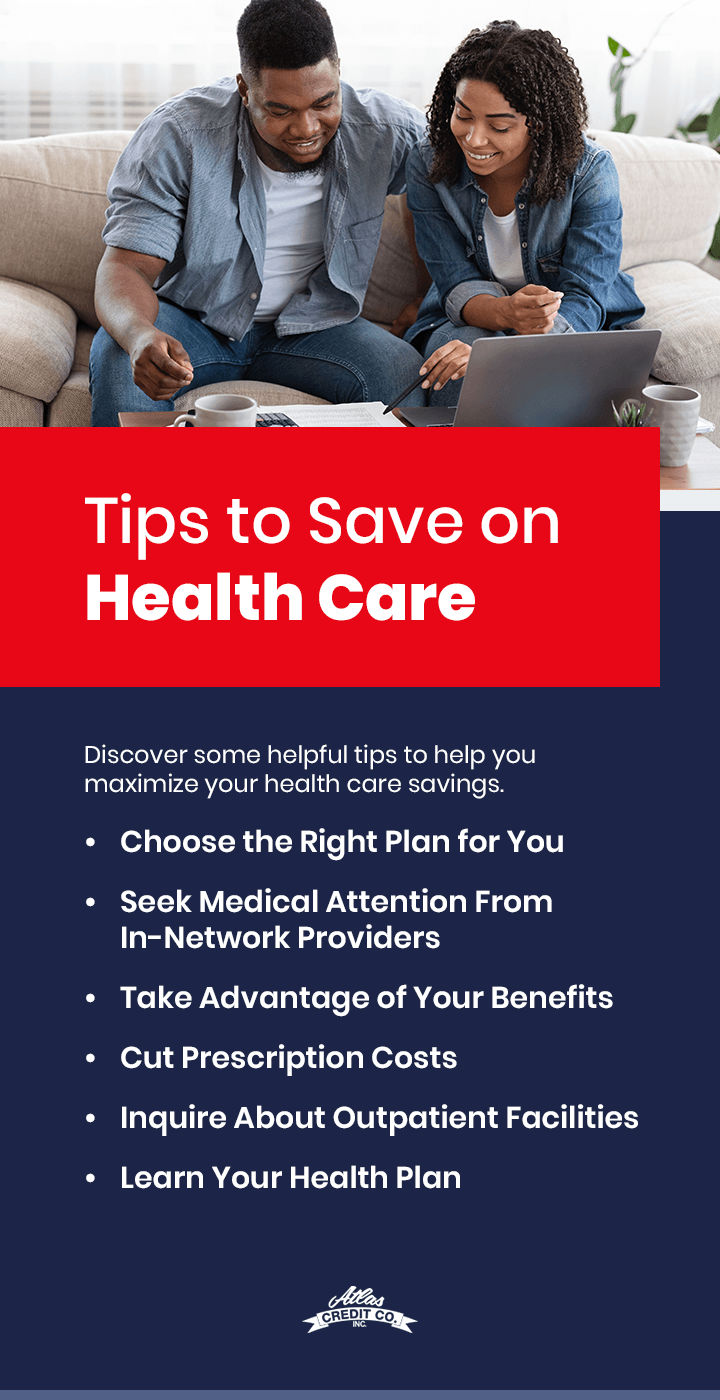

Tips to Save on Future Health Care Expenses

Health care costs continue to rise. Fortunately, there are a lot of ways to help you save on health care expenses. Discover some helpful tips to help you maximize your health care savings.

Choose the Right Plan for You

Since every health plan is different, choosing the best coverage for yourself and your family may seem overwhelming. While higher-premium health plans cost more each month, they also tend to provide more extensive coverage. If you have medical needs that require continuous care, a higher premium could prove beneficial.

However, if you do not need such an extensive health care plan, choosing one with a higher deductible and a lower premium could help you save money in the long run. Also, be sure to consider factors such as prescription drug coverage and whether you need vision, dental or mental health coverage.

Seek Medical Attention From In-Network Providers

As mentioned earlier, medical attention can cost a lot more out of pocket if the providers are out of network. One of the easiest ways to save expenses from this issue is to exclusively choose in-network providers. Since those professionals have a contract with the insurance company, it will typically result in lower charges for your medical needs. Contact your insurance company and they'll provide you with a list of all in-network providers available to you.

Take Advantage of Your Benefits

If your insurance company provides medical benefits, be sure to use them. Your insurer likely offers full coverage for preventive health measures such as mammograms, vaccines, and wellness visits. Pregnancy also generally warrants full coverage. If you are unsure what benefits you're eligible for without incurring additional out-of-pocket expenses, consult with a health plan advocate. A medical case manager can also help you find the best uses of your benefits, especially if you have a chronic condition.

Cut Prescription Costs

A great way to save on health care is to be proactive in getting the lowest price for prescription medications. Ask your health care provider for the generic form of the prescription drug instead of the name brand. In most instances, the generic brands cost less, but are chemically identical. You can also ask if there is a cheaper alternative to the medication they are prescribing. You can also get over-the-counter (OTC) medications from discount or wholesale stores at a lower cost. Additionally, remember to always take your prescription medications as directed to prevent any further health issues.

Inquire About Outpatient Facilities

If your doctor recommends a specific treatment or surgery, it can never hurt to ask if you can have it done at an outpatient facility. Outpatient clinics tend to cost less than having the same procedure done in the hospital. Your insurance provider may be willing to cover more costs associated with an outpatient procedure.

Learn Your Health Plan

Learn how to save money on health insurance by familiarizing yourself with your health plan. Every health plan has three primary components you should understand and pay close attention to. Get comfortable with how each of the following influences your health care costs.

- Deductibles: These are the amount of money you must pay out of pocket before your benefits can begin. Well-child visits, annual physicals, and other preventive care may incur no extra costs if you choose an in-network provider. Additional medical needs will be your financial responsibility until you pay the required deductible.

- Network providers: Staying with in-network providers will allow you to save money, as your insurance plan will pay more of the medical expenses. A network consists of doctors, pharmacies, clinics, and hospitals that have agreed to work with your insurance company to offer discounted rates.

- Copays/coinsurance: These terms refer to how much you must pay to visit a doctor or have a procedure done, regardless of whether you have paid your deductible. However, if you stay in-network, preventive care measures remain at no cost to you.

Help Build Your Health Care Savings With Atlas Credit Co.

Are you trying to figure out how to save for medical expenses or pay off health care bills? Let us help you with a quick and simple personal loan. At Atlas Credit, we have served our customers since 1968. We offer various long-term repayment options, which means more medical expense savings for you while making smaller payments to us. We will work with you to help you make sure you have a loan repayment plan that best suits your budget.

We offer the best online personal loans ranging from $100 to $1,400. Even if you have bad credit or no credit, don't worry! At Atlas Credit, every customer is more than just a credit score. We regularly provide loans for people with less-than-perfect credit to help them get back on track. Our entire process is transparent, and our terms and fees will not change throughout the loan agreement. When you work with Atlas Credit, you get nothing less than superior customer service from start to finish.

To apply for a personal loan with us today, call us toll-free at 903-258-9965 or submit an online loan application.